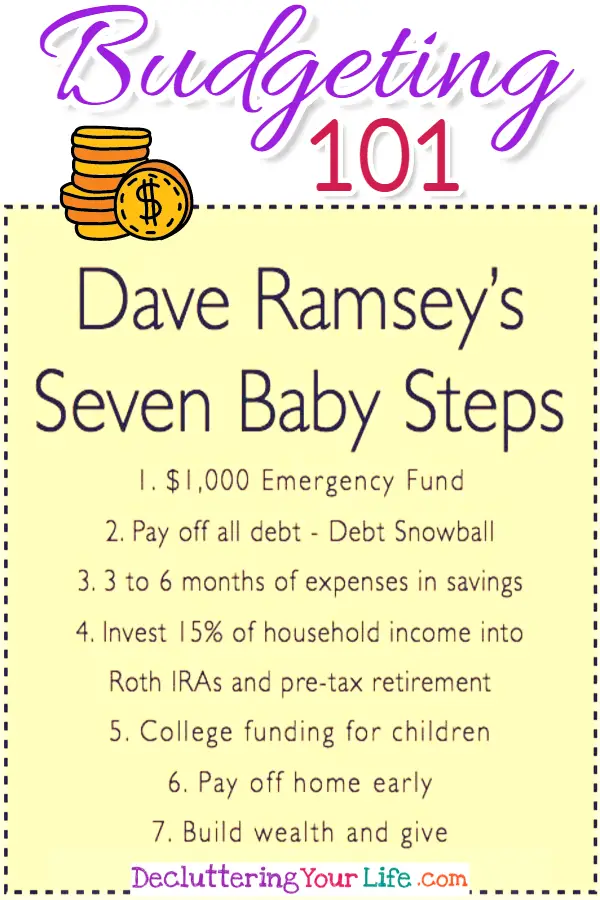

Budgeting 101 Dave Ramsey Style!

Have you heard of Dave Ramsey’s ‘Debt Snowball’? Do you wonder if the Debt Snowball debt reduction strategy even WORKS anymore? When it comes to Dave Ramsey’s Baby Steps, paying off debt with the Debt Snowball method is Baby Step #2. That’s just how IMPORTANT paying off debt is to your over-all financial situation! Paying off debt is even more important than SAVING money!

Financial PEACE, becoming Debt FREE – all sounds great, right? Here’s how to do it with smart budgeting tips and Dave Ramsey’s Debt Snowball.

Debt Snowball Step By StepShow Me ThisDebt Snowball WorksheetsShow Me This

How The Debt Snowball Works:

The debt snowball works like this (and YES, it DOES WORK!)

Step 1: List your debts from smallest to largest regardless of interest rate.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Pay as much as possible on your smallest debt.

Step 4: Repeat until each debt is paid in full.

Those Debt Snowball method steps (1) are “all” there is to it.

In short, you pay off your debt from smallest debt to largest!

If you stick to it, and do the strategy exactly as described, it does work.

The “trick” is sticking to it =)

What makes the Debt Snowball easier than other methods is that this strategy is not about math or any type of fancy budgeting calculations.

You just list your debts on a piece of paper from smallest to largest, and then work to pay off the smallest FIRST while paying minimum on all your other debts.

AND, by paying off your smallest debts FIRST, you are more likely to see PROGRESS quickly.

And that is VERY motivating!

Dave Ramsey is one smart cookie!

Here’s the Dave Ramsey Debt Snowball Calculator to get your started with YOUR Debt Snowball plan:

Debt Snowball Calculator | DaveRamsey.com

Using the form below, answer five questions about your different debts. Based on your answers and national research data, we’ll tell you the estimated amount of time it will take you to pay off your total debt. What is the balance of your credit cards? What is the balance of your car loan(s)?

I don’t know how many of you listen to the Dave Ramsey radio show on a semi-regular basis, but I LOVE it!

I always hear great budgeting tips!

Plus, every time I listen in, I let out a few hearty AMEN’s to what is shared from his callers when they yell, “I’m debt free!”

Dave Ramsey is like THE guru of personal finance and has his own step-by-step method to get OUT of debt and obtain financial peace.

Among his very specific seven steps to financial freedom and becoming debt free is something Dave Ramsey calls his Debt Snowball Form, listed as step number 2 below.

Welcome to Decluttering Your Life - we hope you enjoy our quick decluttering tips, organization ideas and simple DIY solutions for your home - posts may contain ads & affiliate links - that's how we keep the lights on =)

Get 25% Off ALL Printables and Planners with discount code: MOMHACKS

=> See all printables here

[content-egg module=Amazon template=grid limit=3]

Like a lot of national radio shows, Dave invites listeners to call in, and in a lot of those cases, the listener is reporting that, via the principles discussed on the show, the caller can exclaim, at the top of their lungs, “We’re debt free!” backgrounded by Mel Gibson’s declaration of “Freedom!” from the movie Braveheart.

It’s quite inspiring!

I’ve noticed an interesting and positive pattern with these callers.

When caller announces that they are out of debt, Dave will typically ask the caller what their income was during the journey.

(After all, the two biggest factors in understanding the size of their challenge would be know how much debt they paid off and – you guessed it – how much money they make!)

It has been rare, if ever, that the caller identified their income as being the same at the beginning of the process as it was at the end. To put a finer point on this, it’s also been rare that the caller’s income went anywhere but up!

[content-egg module=Amazon template=grid next=3]

Now, how it went up has been different from person to person.

One family may have discovered some assets they decided was okay to sell – once they decided that killing the debt was worth sacrificing the asset.

Some people moonlighted selling pizzas, others had their newfound financial discipline discovered by their employer and they got a promotion as a result.

Some people looked for part-time businesses at home.

It has always been different, but it has always been something to increase how much money they bring IN every month!

For me, I learned how to afford to be a stay at home mom – and that made a BIG difference.

11 Steps to Start a Money Making Mom Blog in 2019 - the Right Way

After taking Suzi's Blog By Number course, things started to change. I had my blog up and running in a week, and started publishing consistently. I started making money consistently. I started getting income from affiliate marketing, and even launched my own course!

Here’s how the Debt Snowball works:

[content-egg module=Amazon template=grid next=3]

Dale Carnegie once wrote:

“When the student is ready, the teacher will appear.”

I certainly would not have accomplished what I did had I been content being where I was – I had to WANT to change, ya know?

What I see in people doing with the Dave Ramsey Debt Snowball is deciding that they have had enough; they’re becoming the student. I salute them. They are a testament to people taking charge over the masters in their lives, and turning back over to the True Master!

More Help:

Can YOU Afford To Be a Stay at Home Mom?

Whether you’re expecting your first baby, or have multiple kids, a BIG question moms ask is – “Can I AFFORD to be a stay at home mom?” Here’s how to KNOW if YOU can afford it – or if your family would go BROKE – and deeper in debt – …

- Cute Baby Shower Basket Ideas For a CHEAP Homemade Gift

- Party Finger Food Ideas – Budget Friendly Make Ahead Nibbles, Dips and Appetizer Platters

- Brunch Food Ideas To WOW Your Party Crowd (recipes from our Mother’s Day potluck)

- Make Ahead Dinners – 19 Easy Throw Together Crockpot Meals With VERY Few Ingredients