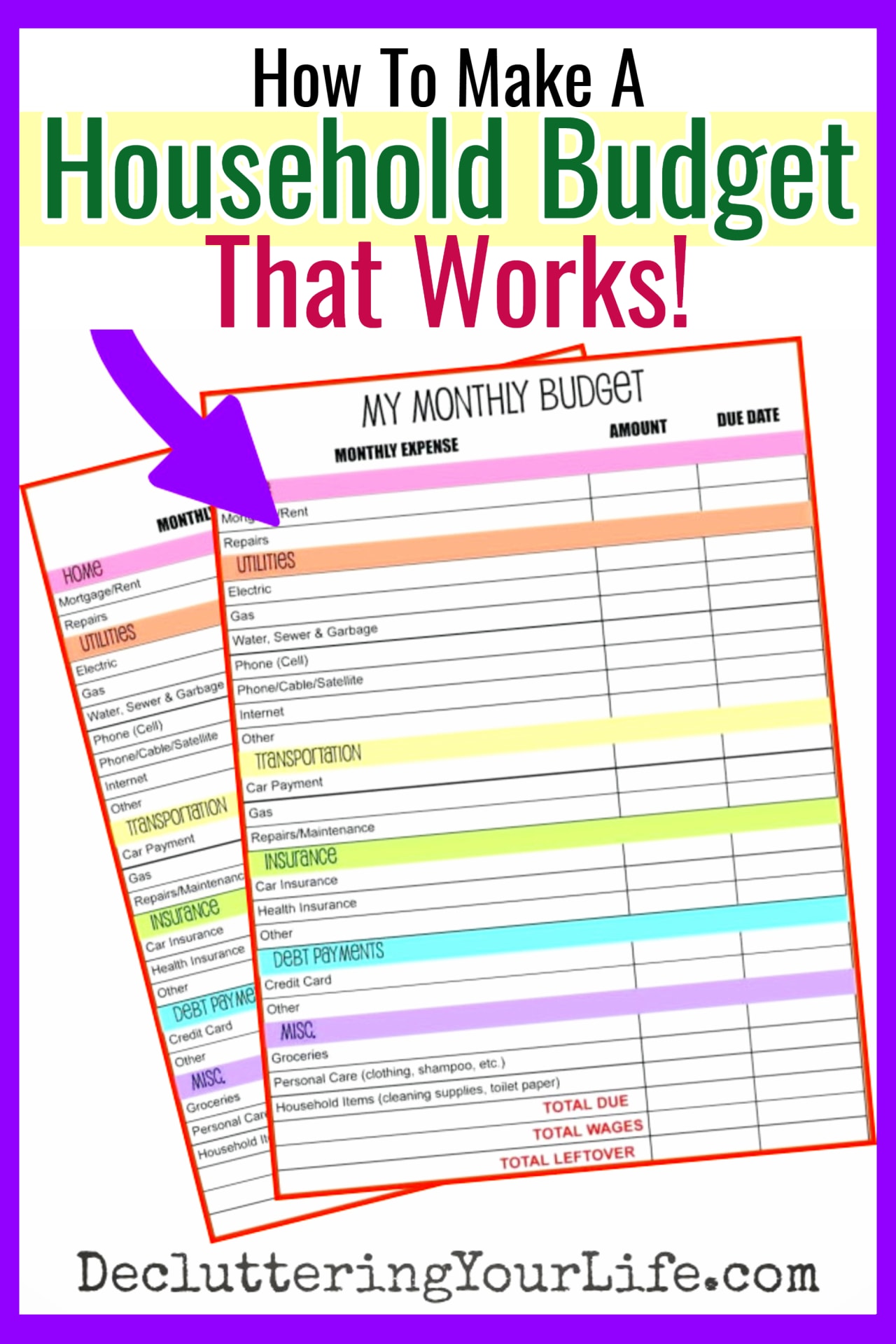

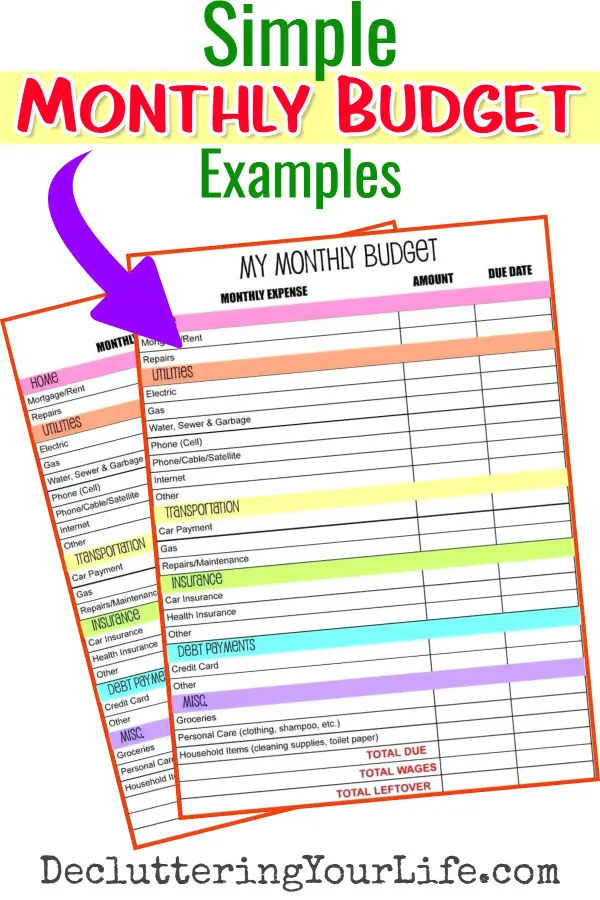

The best way to track expenses and budget your money is with a simple family/household budget. Many readers ask me how to manage their budget AND save money, what percentage of income should go to bills, and tips for budgeting for baby on ONE income – here’s an example of a simple budget that WILL help you keep track of paying bills, be able to save money and keep your family budget on track.

Welcome to Decluttering Your Life - we hope you enjoy our quick decluttering tips, organization ideas and simple DIY solutions for your home - posts may contain ads & affiliate links - that's how we keep the lights on =)

Get 25% Off ALL Printables and Planners with discount code: MOMHACKS

=> See all printables here

Quite often, we Moms are the CFO’s of our family – meaning; we are in charge of the household budget, paying bills, and accounting for every penny spent. This can be (one more) over-whelming chore on our plate, but with some simple budgeting tips you can easily set up an effective family budget plan that works.

We used to be so overwhelmed with how to actually stick to a budget - I thought we were doomed to be yet another family that barely scraped by paycheck-to-paycheck.

Instead of just accepting it, I got help - and it made ALL the difference in the world!

This workbook made it so easy.

We just filled it out in order and by the end we were finally in control of our money.

And - as of this week...

We are NOW 100% credit card debt free!

This is the budget workbook we used

5-Step HouseHold Budgeting

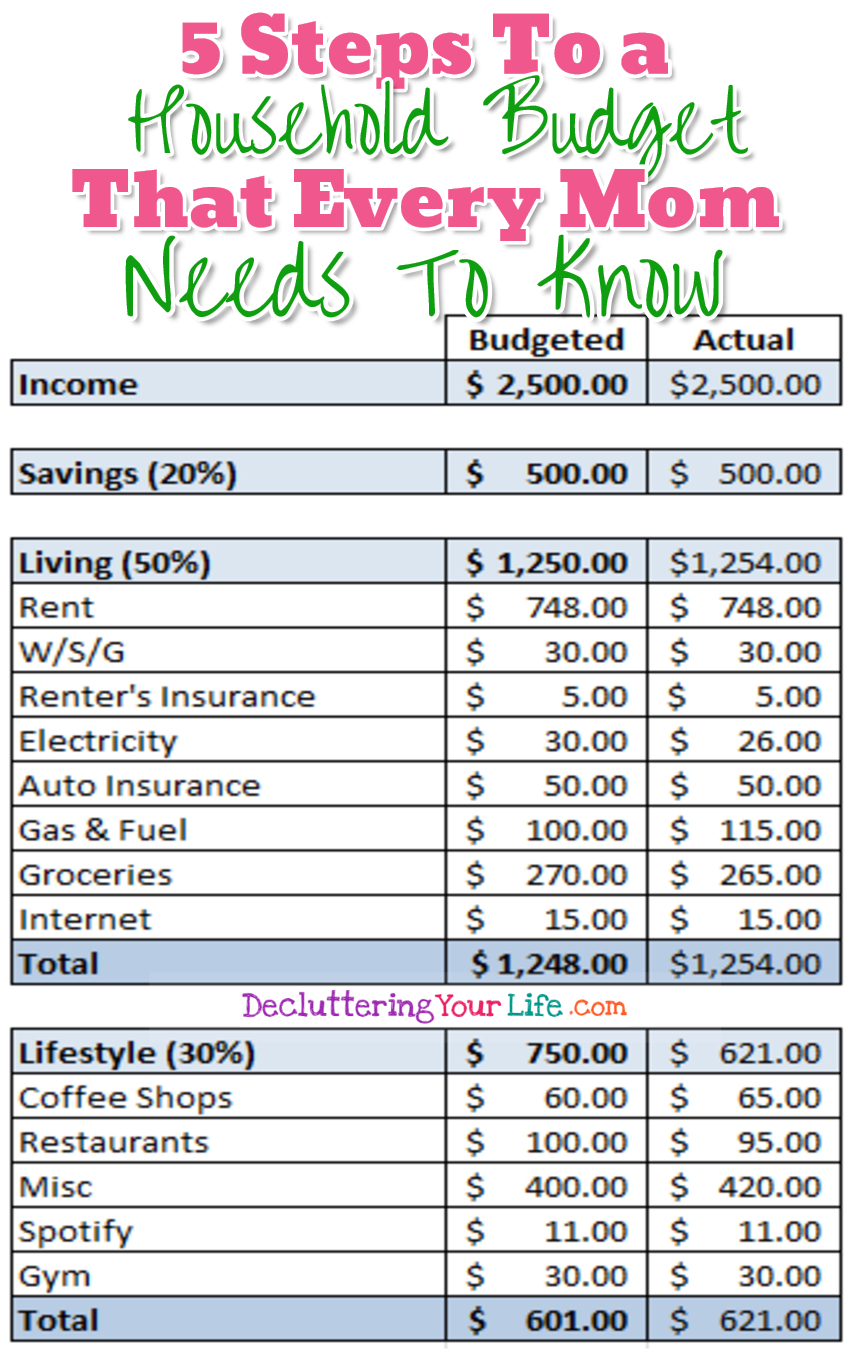

Household budgeting can make the difference between not having enough to pay your bills at the end of the month and having a little left over to save up for a nice family vacation. It takes an effort to get started but simply requires you to get in the habit of doing things a certain way, and thinking about the money you spend – before you spend it. With just a little practice it becomes second nature. Here are 5 steps to put you on the path to financial freedom.

1) Figure out your monthly take-home pay

How much do you actually bring home?

Your monthly take-home pay is simply how much money you bring home each month. Your take home pay is your income minus whatever comes out before you get your paycheck – taxes, social security, insurance, etc. The actual check that you cash is your take home pay.

Who else contributes?

Are there other members of your family who contribute their monthly paycheck to the family coffers? If so, total the paychecks (after taxes and other deductions!) of every household member with an income. This total is the beginning of your monthly budget.

[content-egg module=Amazon template=grid limit=3]

2) Figure out your monthly expenses

Where is your money actually going each month?

Many people are surprised when they review credit card and other bills and find things they’ve forgotten about spending money on – or didn’t know about in the first place. What is being purchased from your household money? How many people, besides the ones who earn income, have access to this money? remember, a household is often made up of earners and non-earners – but even the non-earners can spend money! Teenagers often have a credit card in their own names which is paid by their parents – these expenses must be taken into account as well.

It’s very important to KNOW where your money goes every month – it’s the difference between living paycheck to paycheck and having enough each month.

Make a list of each and every item you spend on – even if it’s a one-time expense, or seems small – the small stuff can add up to quite a bit by the end of the month. Common expenses include:

• Food

• Clothes – both new, and dry cleaning old ones

• Transportation – car, gas, bus, subway, etc. Each person in the household must be accounted for

• Rent/Mortgage

• Utilities

• Medical/Dental expenses and health insurance

• Installment payments for things you don’t fully own yet (car, furniture, appliances)

• Spending money

• Hair care

• Entertainment – cable, movies, DVD rentals, Vacations

• Education expenses – ALL members of the household

• Donations

3) Figure out how much you are spending on each expense

How much does each item on the list actually cost you each month

This takes some thought to answer properly – chances are, many of the expenses on the list will be variable each month – if someone gets sick, for instance, that month’s health expenses will be higher.

Make sub lists:

a) Bills that stay the same each month, like mortgage and rental payments

b) Bills that change monthly like utilities and entertainment

c) Bills that come every 3 to 6 months, or annually – divide by how often it comes to figure out how much you need to save each month in order to be able to pay the bill when it comes. Plan ahead so the money is there when the bill arrives – DON’T use money you had budgeted for the months ahead to pay a bill for services used in the previous months.

d) Bills that come more than once a month like gas, food and entertainment. Keep close track of these because they are often major contributors to the “bottomless pit” that is our finances.

e) Unexpected bills – surprise happen, like going for your regular dental checkup (a regular, known expense) and finding out you have a few cavities to fill. Or perhaps you saw a really good sale on something you were going to buy soon, but hadn’t budgeted for. Figure out how much you can afford to set aside each month

[content-egg module=Amazon template=grid next=3]

4) Decide if your monthly expenses match your take home pay

If you’ve included all your recurring and predictable one-time expenses you should be able to see at a glance whether or not you are spending more than you are bringing home. If you find there is money left over at the end of the month, congratulations! Decide how much you want to put in savings each month and how much you want to be able to spend.

If you find that you are spending more than you are earning, review your list of expenses to see where you can cut back. Do you need to eat out as often? Can you see fewer movies? Even if you do have a small surplus each month you still might want to consider cutting back a bit on expenses so those unexpected costs like a raise in gas or food prices, or throwing a party for friends, don’t leave you with less than you need to pay your bills.

[content-egg module=Amazon template=grid next=3]

This brings us to the last and most important step:

5) Find ways to balance your budget

Decide what you can cut from your monthly budget. What can you do without? Can you read fewer newspapers, or read them online? Try to find creative ways to spend less on the things you really want – like shopping only when there are sales, or finding outlet stores to buy from.

More important of all – be realistic! Don’t cut things you won’t be able to live without. Food might not be a fun expense but it can’t be replaced with movies or shopping. If your budget isn’t realistic you won’t be able to stick with it.

Regular savings MUST be a part of your overall budget. You must plan to put away a certain amount of money each and every month. Whether you plan to spend this on an occasional treat for yourself or family, or on a family vacation – the time will come when you will need a little extra so it’s important to plan in advance.

After you’ve made cuts to your budget, re-balance your income and expenses. Make sure you have the money you think you should have at the end of each month.

It is very helpful to keep a financial diary for a month or two to confirm that you are spending on the things you put into your budget. You may find you are spending more or less than you thought, or that you are spending on different items than you had planned. Once you figure out where the money is really going, update your budget.

Don’t be afraid to review your budget every 6 months or so to see how things might have changed – nothing should be set in stone. Your daily activities and even hobbies change over time – make sure your household budget keeps up with your lifestyle!

[content-egg module=Amazon template=list]